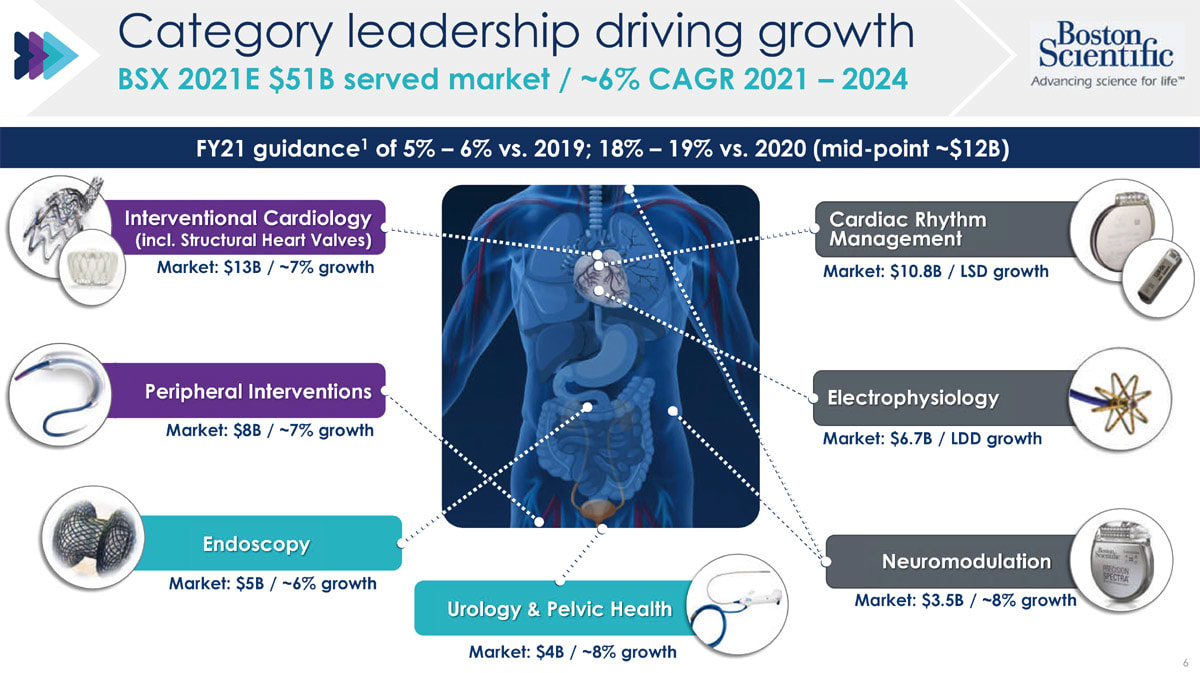

Driving growth with portfolio innovation, globalization, and new capabilities in 2022 will position Boston Scientific to deliver on its promise to “transform lives through innovative medical solutions that improve the health of patients around the world.” Recently closed M&A deals in 2021 are a key contributor to the company's goal of shifting to high-growth markets. This article looks at the company's strategies for achieving revenue growth during the COVID-19 pandemic and factors that will drive the company going into 2022.

“I'm very proud of the agility and winning spirit of our employees and continue to be impressed with the resiliency of hospital systems and their ability to provide patients with the care they need during the pandemic,” said Mike Mahoney, chairman and chief executive officer of Boston Scientific in a recent earnings call.

Mahoney noted that all of the medtech giant's business units either maintained or gained share in the fourth quarter, despite the challenges COVID-19.

“We look forward to the year ahead and remain bullish on both the near-term and longer-term opportunities we laid out at our Investor Day in fourth quarter 2021. Total company operational sales grew 17 percent versus 2020, while organic sales grew 15 percent, achieving the high end of our guidance range of 12-16 percent.”

In the company's fourth quarter 2021, Mahoney said organic sales grew 7 percent compared with 2019, and full-year 2021 operational sales grew 19 percent versus 2020. Organic sales grew 19 percent, again achieving the high end of Boston Scientific's guidance range of 18 to 19 percent, said Mahoney.

“Turning to 2022, while we anticipate less of a COVID impact on underlying procedures for the full year 2022 versus 2021, there we are providing a wider range to account for uncertainty related to COVID waves and staffing shortages,” said Mahoney. “Despite the near-term macro-economic pressures in 2022, we continue to target operating margin expansion with a goal of double-digit adjusted EPS at the high end of the range.”

A Road Paved with Innovation — and Acquisitions

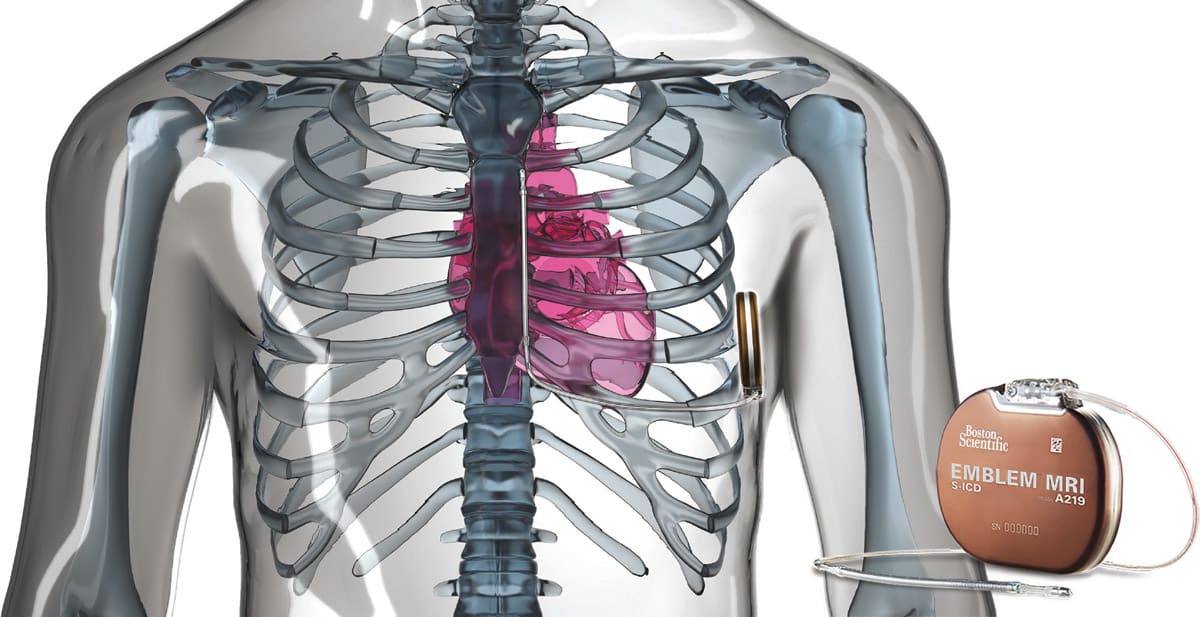

The company, founded in 1979, began its journey with a peripheral angioplasty balloon using polyethylene. The then developed its adult aortic valvuloplasty balloon, its first major cardiology product. According to the company, the balloon is cited by the FDA as one of the nine most significant regulatory approvals of 1990. Throughout the 1980s and 1990s, the company acquired nine companies — including SCIMED, Heart Technology Inc., and Target Therapeutics — to strengthen its portfolio. And by 2004, it had launched TAXUS Express2 paclitaxel-eluting coronary stent system in the United States. It was one of the most successful product launches in the history of the medtech industry. Over the next decade, the company had additional successful launches, including the Promus Element drug-eluting coronary stent system; the S-ICD™ System, the world's first and only commercially available subcutaneous implantable defibrillator; the Alair Bronchial Thermoplasty System, the first and only device-based asthma treatment, and the Precision Plus Spinal Cord Stimulation System, the world's first rechargeable SCS device for the management of chronic pain of the trunk and/or limbs.

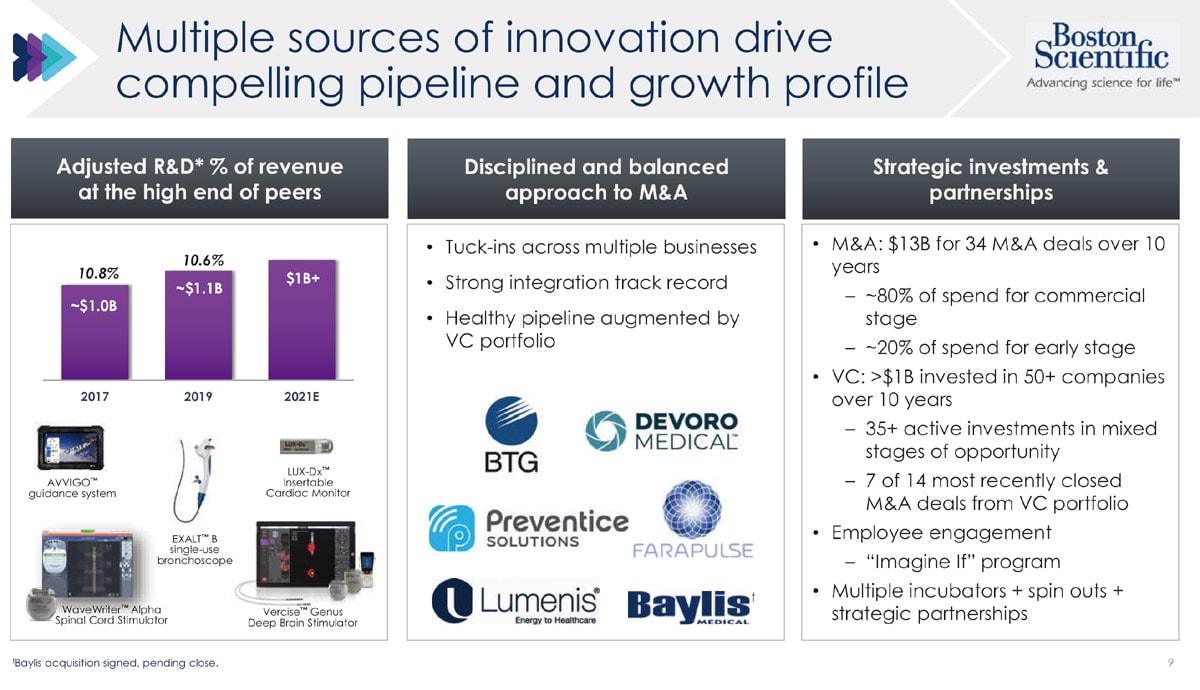

The company completed several acquisitions in 2021, including the global surgical business of Lumenis Ltd. for its proprietary MOSES™ technology, which has demonstrated differentiated clinical outcomes and efficiency in the management of patients with kidney stones. The acquisition strengthened Boston Scientific's urology portfolio as well as its global footprint in Europe and Asia. Boston Scientific also acquired Preventice Solutions for its portfolio of mobile cardiac health solutions and services, ranging from ambulatory cardiac monitors — including short- and long-term Holter monitors — to cardiac event monitors and mobile cardiac telemetry. The transaction consisted of an upfront cash payment of $925 million, with an additional $300 million in a potential commercial milestone payment. Boston Scientific had been an investor in Preventice since 2015, holding an equity stake of approximately 22 percent. In June 2021, Boston Scientific exercised its option to acquire the remaining shares of Farapulse. It had been an investor in Farapulse since 2014 and held an equity stake of approximately 27 percent. The acquisition was designed to complement Boston Scientific's existing electrophysiology portfolio by including the Farapulse Pulsed Field Ablation (PFA) System — a nonthermal ablation system for the treatment of atrial fibrillation (AF) and other cardiac arrhythmias.

“The emerging field of PFA has the potential to alter the future of ablation therapy and has shown the promise of improvements in both safety of cardiac ablations for patients and efficiency and ease-of-use of these procedures for physicians,” said Kenneth Stein, MD, senior vice president and chief medical officer, Rhythm Management and Global Health Policy, Boston Scientific. “The Farapulse PFA System is intended to enable physicians to precisely ablate cardiac tissue while minimizing procedural complications, and real-world and clinical evidence from trials throughout Europe have demonstrated encouraging, positive results,” said Mahoney.

Farapulse became the first company to commercialize a cardiac PFA technology after receiving a CE Mark for the Farapulse PFA System in Europe in the first quarter of 2021. The company also initiated its pivotal investigational device exemption (IDE) trial in the United States — the ADVENT trial — in March 2021. The study is comparing the Farapulse PFA System to standard-of-care ablation in patients with paroxysmal — or intermittent — AF with a primary endpoint of freedom from AF at 12 months after a single ablation procedure.

In February 2022, Boston Scientific closed its acquisition of Baylis Medical, a company that offers advanced transseptal access solutions as well as guidewires, sheaths, and dilators used to support catheter-based left-heart procedures. This acquisition allows Boston Scientific to integrate the Baylis platforms with its existing electrophysiology and structural heart offerings, further strengthening its position within high-growth cardiology markets.

Growth Through Innovation

Urology and Pelvic Health. In Q4 2021, the company's urology and pelvic health sales grew 9 percent on an organic basis compared with Q4 2020, and 19 percent on a full-year basis versus 2020.

“Within the quarter, SpaceOAR and Rezum both grew double digits, and we're pleased with the 2022 improved reimbursement for the ASC and hospital outpatient setting for Rezum,” said Mahoney. “On a full-year basis, we saw strength across the business with double-digit growth in Litho-Vue, CorStone, Rezum, SpaceOAR, and erectile restoration. As we look forward toward 2022, we remain excited about our strong leadership position, further extended by the acquisition of Lumenis in the market-leading MOSES laser technology,” he said.

Turning to endoscopy, he said that sales grew 10 percent organically versus fourth-quarter 2020, with full-year growth of 19 percent versus 2020 and 2021. Over the duration of the year, broad-based strength across all regions and franchises resulted the company's endoscopy business achieving $2 billion in 2021, he noted. Within the quarter, the company launched the Axios stent in China, and then grew the product line over 20 percent globally.

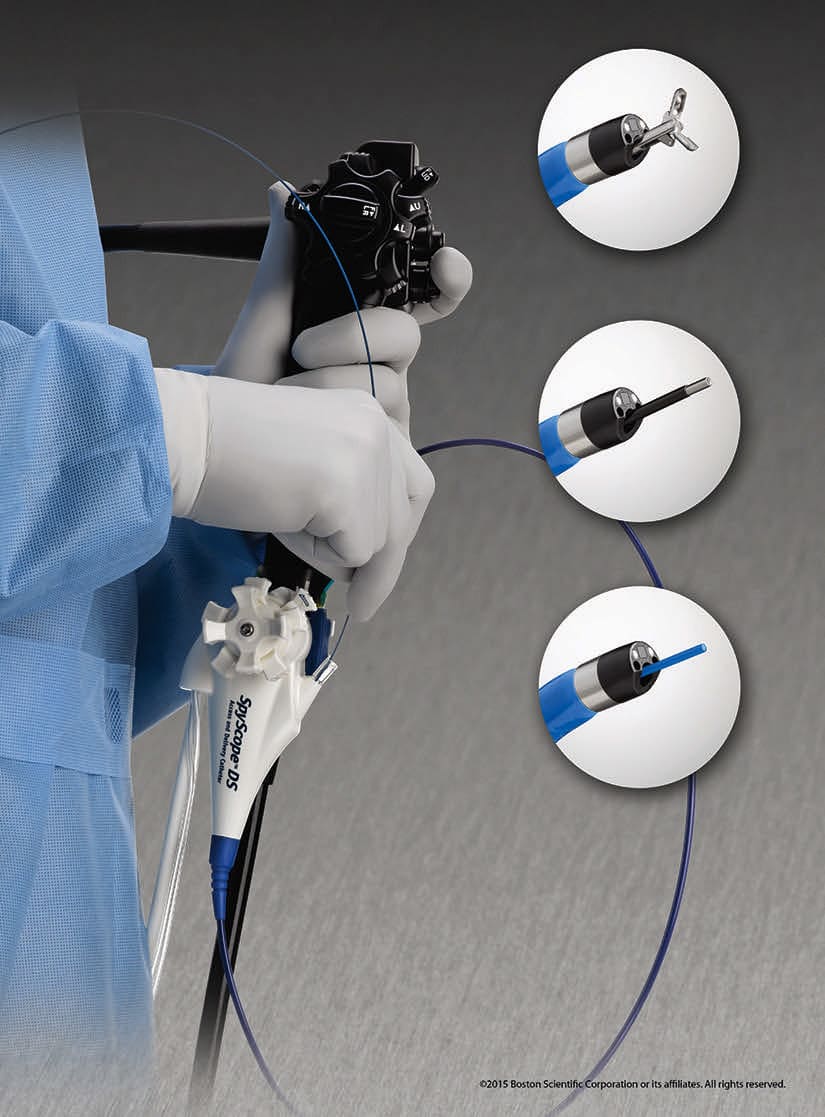

“We remain excited about the outlook of our innovative offerings within our single-use imaging portfolio, including a SpyGlass DS, EXALT Model D, EXALT Model B, and SpyGlass Discover. Looking at 2022, we continued to anticipate above-market growth as the endoscopy global commercial teams continue to execute at a high level by creating long-term partnerships and possibilities that give a unique breath and differentiation of our portfolio.”

The single-use EXALT Model B bronchoscope was specifically designed and optimized for bedside procedures and features suction capabilities and the familiar feel found in reusable models — all combined with the peace of mind offered by a sterile single-use device. The SpyGlass DS System enables direct visualization of the pancreatic and bile ducts, is used to evaluate suspected benign and malignant conditions, and is used for the treatment of difficult stones and strictures. The SpyGlass Discover Digital Catheter is intended to provide direct visualization and to guide both optical and accessory devices for diagnostic and therapeutic applications during endoscopic procedures in the pancreaticobiliary system including the hepatic ducts.

Cardiac Rhythm Management. Organic sales of CRM products grew 8 percent compared with 2020.

“In Q4, a high-voltage business grew low single digits, which we expect was in line with the market with improved sequential growth in our S-ICD franchise and enabled by our Hands Electro launch in June. The pacer business grew mid-single digits, which was likely in line with market,” said Mahoney.

In December 2021, the company enrolled its first patients in the modular ATP trial, a dual-track clinical study to investigate a standalone leadless pacemaker and to provide antitachycardia pacing to Emblem S-ICD patients.

Diagnostics. Within the diagnostics franchise, Boston Scientific's implantable cardiac monitor, LUX Dx continues to perform well, said Mahoney. The LUX-Dx ICM System provides a dual-stage algorithm that is capable of rejecting false positives. Remote programming technology lets physicians make critical adjustments without bringing patients into the clinic for another appointment.

“The preventive business grew 20 percent in a full-year pro forma basis, enabled by our differentiated portfolio and strong execution. Electrophysiology sales grew 23 percent versus 2020. Importantly, the international EP sales grew 38 percent fueled by our innovative portfolio including PolarX, Stablepoint, and Farapulse. The early Farapulse launch is going well in Europe with physicians enthusiastic about the safety and ease of use of this technology. We're very excited about the outlook of the business,” he said.

Neuromodulation. Despite the COVID wave impacting procedure volumes, Mahoney said the company continues to gain share in this sector with strong demand for its WaveWriter Alpha SCS systems. Ongoing clinical evidence has resulted in a full-year SCS growth rate of over 20 percent versus 2020.

“We presented various data sets in NANS [North American Neuromodulation Society], including the two-year combo RCT data supporting the longevity of our SCS therapy. We continue trials to study WaveWriter SCS systems for the treatment of patients with chronic low back and/or leg pain who have not undergone spinal surgery and anticipate initial clinical work on [diabetic peripheral neuopathy] in the coming months.”

Deep Brain Stimulation. While COVID impacts procedure volumes, Mahoney said that the company has continued to enhance its deep brain stimulation portfolio and capabilities, including expanding its Vercise Genus offering in partnership with Brainlab in 2022.

Interventional Cardiology. In interventional cardiology, the company's organic sales grew 40 percent in fourth-quarter 2020 and 31 percent versus the full year 2020. “This includes a tailwind of approximately 1000 basis points related to sales return reserves for the transition to consignment for Watchman in 2020,” said Mahoney. Left atrial appendage closure (LAAC) with Watchman is a one-time procedure that reduces the risk of stroke in nonvalvular atrial fibrillation (NVAF) patients and reduces the risk of bleeding that comes with a long-term oral anticoagulant use. The device is permanently implanted at or slightly distal to the opening of the LAA, which is known to be the source of more than 90 percent of stroke-causing bloods clots in people with non-valvular AF.

“In coronary therapies, our complex PCI — percutaneous coronary intervention — franchise had strong growth in 2021 with strength across every region further enabled by the recent launch of our AVVIGO guidance system in EU. With drug-eluting stents, we continue to differentiate our portfolio with the global launches of Synergy 48 mm and Megatron,” said Mahoney. The Synergy Megatron is an Everolimus-eluting drug and bioabsorbable polymer designed help to enable early healing. Unlike permanent polymer drug-eluting stent technology, the bio-absorbable polymer is gone shortly after the drug is completely eluted. “We continue to anticipate being first to U.S. market in 2024, with our Agent drug-coated balloon. We are extremely pleased with the performance of Watchman franchise in the fourth quarter as sales surpassed our expectations.”

Importantly, he said, the 2021 global performance of Watchman was consistent each quarter with strong double-digit growth, resulting in full-year sales of $830 million. “We continue to be pleased with our ability to deliver the safest and most efficient therapy and increase physician utilization and global expansion while driving greater awareness to this fast-growing LAAC market.”

Peripheral Interventions. Organic sales grew 14 percent over 2020. Mahoney noted that within the company's drug-eluting portfolio, the globalization and ongoing clinical evidence supporting ALLUVIA and Ranger resulted in exceeding sales goal of $150 million for 2021. The company's varicose vein offering, Vericena, grew over 40 percent in 2021.

Interventional Cardiology. In interventional cardiology, TheraSphere grew over 20 percent on a full-year basis, supported by ongoing clinical evidence including the Epoch trial. The trial is the first positive phase three SIRT trial studying TheraSphere as a second-line therapy in patients with liver-dominant mCRC who have failed first line chemotherapy.

“Our focus on improving patient health comes with a responsibility to have a positive impact in the world we share,” said Mahoney.

Corporate and Social Impact

Boston Scientific received the 2022 Catalyst award, recognizing its initiatives to advance women in the workplace. Also, in January 2022, CNBC and Just Capital released their 2021 list of America's top 100 JUST companies, and Boston Scientific ranked 50 out of nearly 1,000 companies, first among companies in the healthcare equipment and services industry and number one for workers and the environment in the medtech industry. The JUST 100 list ranks companies on issues such as creating jobs, providing benefits and work-life balance, cultivating a diverse and inclusive workplace, producing sustainable products, and building stronger communities.

“Our environmental, social, and governance practices guide us as we make long-term measurable progress,” said Mahoney. “I am grateful for the passion and commitment of our global team as we continue to live our values and do our part to create a better future, both as a global business as a global corporate citizen. While we have faced challenges over the last few years of COVID, we are stronger for it. We're building new capabilities that will enable us to better serve our patients and customers, both today in the future,” he said.

Mahoney noted that the company is well positioned in 2022 with “category-leading innovative product positions and continue to focus and invest in clinical evidence while continuing to enter high-growth adjacent markets.”

“We acquired several companies in the past year with innovative products that are creative markets, and we continue to develop our leadership and commercial structures to best enable these exciting new technologies,” he said. “We remain committed to our long-term financial goals of 68 percent organic revenue growth, operating margin expansion, and double-digit adjusted EPS growth with strong cash flow generation. I'm very grateful to our employees for the winning spirit.”

This article was written by Sherrie Trigg, Editor and Director of Content. She can be reached at